Equator Principles (Sustainability Reports)

Concern for sustainable development is a constant in the contemporary zeitgeist. For this reason, companies and financial institutions are seeking to commit deeply to social, economic, and environmental spheres to create sustainable value. Stakeholders are discovering the vital significance embedded in concepts encompassed by this perspective: economic growth, environmental protection, and social equity, striving to assign value to multiple economic, ecological, and social issues that enhance the value of their operations.

While integrating social, economic, and environmental factors is fundamental in today's global landscape to ensure balanced, secure, and prosperous economic development, stakeholders agree that any investment can have profound consequences on society and everyone's lives. This is because large industrial and infrastructure projects can generate adverse impacts on people and the environment. This is even more critical in emerging markets where regulatory frameworks are fragile. If financial institutions wish to operate in these markets, clear, understandable, and responsible investment standards must exist.

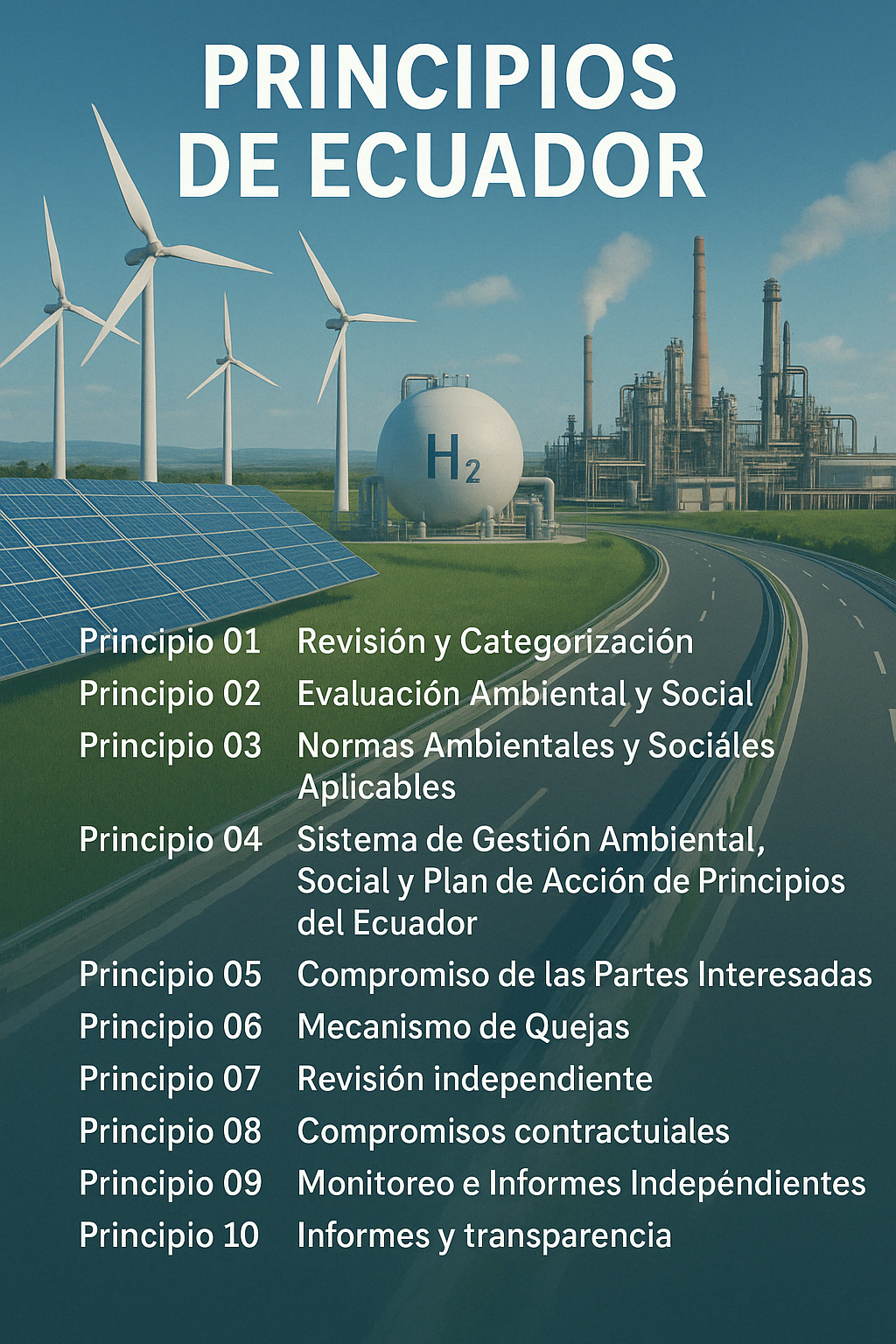

The Equator Principles (EP) represent a set of standards promoted by financial institutions aimed at identifying, assessing, and managing the social and environmental risks arising from large industrial and infrastructure projects during the financing phase. These principles comprise ten guidelines through which adopting financial institutions voluntarily commit to evaluating and considering the social and environmental risks associated with the investments they fund, thereby ensuring the sustainability of the financed activities. This framework allows for the determination and management of the social and environmental risks of such projects.

By adopting the EP, international financial institutions ensure that projects are developed in a socially responsible manner and reflect sound environmental management practices. It is recognized that the application of these principles can contribute to achieving the United Nations Sustainable Development Goals (SDGs). As financiers and advisors, these institutions work closely with their clients to identify, assess, and manage environmental and social risks in a structured and ongoing manner. This collaboration promotes sustainable environmental and social performance, which can lead to better financial, environmental, and social outcomes.

Banks apply the EP globally across all industrial sectors. These principles are based on the policies and guidelines of the World Bank and the International Finance Corporation (IFC), the agency that has driven them.

In today's world, sustainability is not just an option but a necessity for companies and financial institutions that wish to thrive and maintain their reputation in the global market. Our consulting firm is committed to helping our clients navigate this complex landscape by offering consulting services for the development of Sustainability Reports based on the Equator Principles.

Why choose AI as a strategic partner in this important effort:

Expertise and Specialized Knowledge

We have a team of highly qualified experts in the assessment and management of environmental and social risks. Our experience in large renewable energy, infrastructure, and hydrocarbon projects, as well as in urban planning and territorial development, allows us to provide a comprehensive and detailed perspective in the preparation of sustainability reports.

Compliance with International Standards

The Equator Principles are a global benchmark in environmental and social risk management. Our methodological approach is aligned with these standards, ensuring that the reports we develop not only comply with local and international regulations but also reflect global best practices in sustainability.

Personalized Approach

Each company and project has unique characteristics and needs. We work closely with our clients to understand their specific objectives and tailor our services to accurately reflect their performance and commitment to sustainability. Our personalized approach ensures that each report is an authentic and precise reflection of the organization's practices and achievements.

Comprehensive Management Capability

Our service covers all stages of the sustainability reporting process: from data collection and analysis to the drafting and presentation of the final report. We handle all technical and administrative aspects, allowing our clients to focus on their core business while we manage the details.

Transparency and Credibility

Sustainability reports based on the Equator Principles require a high level of transparency and accuracy. Our firm is committed to providing reports that not only meet these requirements but also enhance the credibility and trust of our clients among their investors, regulators, and other stakeholders.

Competitive and Reputational Advantage

Companies that demonstrate a strong commitment to sustainability and social responsibility are increasingly valued in the market. By working with us, our clients can strengthen their reputation and differentiate themselves from competitors, showing stakeholders that they are committed to sustainable development and responsible management.

Innovation and Continuous Improvement

We stay at the forefront of trends and advancements in sustainability, incorporating the latest technologies and innovative approaches into our services. This ensures that the reports we produce not only comply with current standards but also incorporate continuous improvement practices for long-term sustainable performance.

About

By choosing our firm for the development of your Sustainability Reports based on the EP, companies and financial institutions are investing in a more sustainable, transparent, and successful future. We are committed to providing comprehensive and personalized consulting services that not only meet the highest standards but also drive the sustainability and long-term success of our clients.

Adopting the Equator Principles offers a number of advantages for both companies and financial institutions. These advantages can be strategic, operational, and reputational.

Principales ventajas de los informes fundamentados en los Principios de Ecuador

Strategic Advantages

- Risk Mitigation: By adopting the Equator Principles, companies and financial institutions can identify and mitigate environmental and social risks from the earliest stages of a project, reducing the likelihood of future legal issues and conflicts.

- Improved Decision-Making: Provides a clear and consistent framework for assessing and managing environmental and social risks, improving the quality of decision-making and the long-term viability of projects.

- Access to Markets and Capital: Many global financial institutions and investment funds prefer to work with companies that demonstrate a commitment to sustainability and social responsibility, which can facilitate access to financing and capital.

Operational Advantages

- Project Management Efficiency: Implementing a structured risk assessment and management process helps companies manage their projects more efficiently and avoid delays and additional costs associated with unmanaged environmental and social issues.

- Regulatory Compliance: By following the Equator Principles, companies ensure that their projects comply with international regulations and standards, which can simplify regulatory compliance and reduce exposure to sanctions.

Reputation Advantages

- Improved Reputation and Brand: Adopting the Equator Principles demonstrates a commitment to social and environmental responsibility, which can improve a company's reputation and public perception, as well as strengthen its brand.

Community Relations: Involving local communities and other stakeholders in the risk assessment and management process can improve community relations, increase social acceptance of the project, and reduce the likelihood of conflict and opposition.

Competitive Advantages

- Market Differentiation: Companies that adopt the Equator Principles can differentiate themselves from their competitors by demonstrating a commitment to sustainable and responsible practices, which can be a deciding factor for customers, investors, and other business partners.

- Innovation and Continuous Improvement: Adopting these principles fosters a culture of innovation and continuous improvement in environmental and social management, which can lead to the implementation of better practices and more efficient and sustainable technologies.

Long-Term Resilience

- Sustainability and Resilience: By focusing on sustainability and risk management, businesses and financial institutions can build more resilient and sustainable operations over the long term, improving their ability to meet future challenges and adapt to changes in the economic, social, and environmental landscape.

Adopting PEs not only helps manage risks and comply with regulations, but also offers significant benefits in terms of reputation, community relations, access to capital, and long-term sustainability.

We create sustainable value

By adopting the Equator Principles, the bank commits to lending only to projects whose sponsors demonstrate, to the bank's satisfaction, their capacity and willingness to adopt certain processes and ensure that they are implemented in a socially responsible manner and with sound environmental management practices. The Equator Principles select projects based on the IFC's environmental and social screening process. Banks classify projects into categories A, B, or C (high, medium, or low environmental or social risk).